Time is running out for Greece

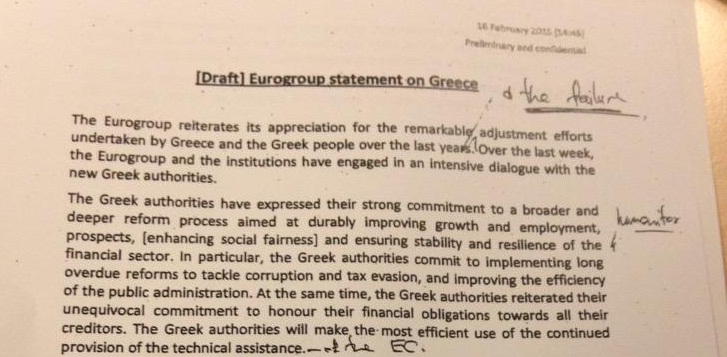

The Eurogroup needed just half an hour to deal with the package of measures presented by Greece in Brussels, pressurizing the Athens government to negotiate the technical issues seriously and in detail with experts from the European Commission, the European Central Bank (ECB) and the International Monetary Fund; the so-called “men in black” of the former Troika. Meanwhile, the Greek authorities do not rule out fresh elections or a referendum on the euro if negotiations prove fruitless.