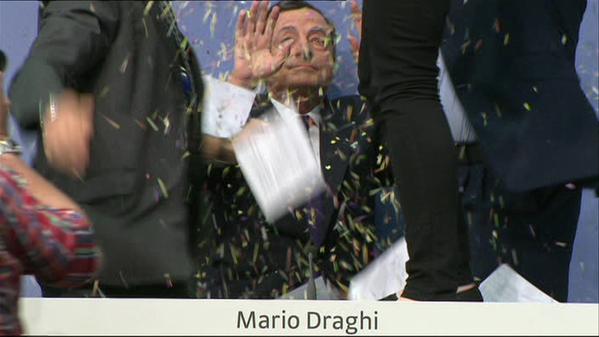

Exciting times at the ECB

European Central Bank (ECB) President, Mario Draghi, was sprayed with confetti by a woman attending the ECB’s press conference on 15 April 2015 in Frankfurt. The woman ran and jumped onto the desk in front of Mr. Draghi, shouting: “end the ECB dictatorship”. There were no injuries and only a brief interruption to the…